My apologies to my readership that I suddenly stopped posting here, but what happened is that graduate school started up again and I am swamped with homework. I do plan to report on my spending for the summer (not good!) and I also need to vent about soccer uniforms, karate instructors and the cost of veterinary care. Regardless, I plan to be back, writing again about personal finance very soon, and I also plan to do a painful assessment of how badly we did over the summer.

How was your summer? Did you save or spend?

Thursday, September 25, 2008

Where'd TInT Go?

Posted by

Missy

at

10:31 PM

0

comments

![]()

Saturday, July 5, 2008

Principles, Ideals and Relationships: Why PF and Hollywood don't mix (to recap)

I love to read J.D.'s fantastic blog, Get Rich Slowly. Not only does he have fantastic, well-written articles that come so fast it's almost too much to keep up, but he has a great readership, and looking through comments often gives me a lot of inspiration for my own, much less read blog.

After responding to a comment on his blog, I came to mine to write about it and realized that, yet again, I've left my blog for too long. I also realized that my last post might be confusing; I argue that giving an expensive gift is better than giving an IRA. I just want to say that if, hypothetically, I was a person who had $7500 to give, I would want to give someone a gift they would want, not a gift to "teach them a lesson." Let me expand on that:

First off, I've spent far too much of my life with people who give me things to teach me a lesson, whether it is political (my in-laws gave me a subscription to the ultra-conservative World magazine for Christmas one year) or religious (I have many, many Bibles from my mother). I get the principle thing, but I'd really just like, oh, I don't know, a candle? Some flowers? Or even an IRA, because that's what I'm into, and I would really appreciate it. My point is: give the gift the other person would want.

Secondly, I wanted to emphasize that the ultra-rich world of Sex and the City is not the real world. Let's not take our personal finance ideas from Hollywood! This is a pretend world that doesn't exist for most people, and we should always keep that in mind. Hollywood is not our teacher, not for relationships (who really has sex with new strangers every week?), not for ideals (like letting the guy buy the apartment), and certainly not for finance (in make-believe, you can make as much or as little money as you choose). Even the writers of the show knew they were stretching.

Last, I think it is important to find balance in life. Sometimes gifts are required in order to keep your social capital, and that social capital can be more valuable than dollars.

I am constantly in the search for balance in life and in finances, and while I am still learning, here's one thing I know: Hollywood ain't got it. And now I've done enough posting about Hollywood (there's too much in this world about Hollywood as it is) so let's get on with some posts about real finances, because that's what Tired in Tucson is about!

Posted by

Missy

at

8:08 PM

0

comments

![]()

Wednesday, June 18, 2008

Sex and The City -- Fun, or bad Finance?

I went to see the new movie Sex and the City a couple weeks ago. I thought it was lighthearted and fun, just like the HBO version. It also tied up more loose ends and had a pretty decent storyline. I came home missing the East Coast and great times with my female friends.

I didn't really think about the show in personal finance terms -- I mean, that episode, where she can't buy her apartment because she spent $40K in shoes? That one did it for me. Ten years ago when I lived in Japan, I saw a lot of articles about women there who would run up $40,000, $50,000 and even $70,000 in credit card debt to buy labels, and I knew that wasn't for me. One woman even used the oven in her kitchen to store extra handbags and coats. Watching the HBO series Sex and the City after I returned home was always somewhat shocking, but it was fascinating too; I remember well Carrie saying she would go without food in order to buy her copy of Vogue magazine. Let's just say I'm a lot more food driven than that.

Nevertheless, I did think about the financial aspect of their lives. I have always thought about "how" it can be humanly possible for a newspaper columnist to make the kind of money Carrie needed to support her lifestyle (I saw a piece about the making of the series that said the writers put the $40,000 shoes episode in to show how an author could manage to buy that many shoes and still live). Of course, her apartment was rent-controlled, but I remember her maxing her credit cards on one show and thinking, gosh, what's the limit on those?

I think that Sex in the City is fun and interesting, in a voyeuristic, what-if-I-blew-money-on-fashion sort of way. As far as personal finances go, Carrie and her group aren't pillars of frugality -- nor does Hollywood paint a fair picture. Ever.

Nonetheless, some articles about finances have erupted from the pure materialism shown in the movie. The money and business section of US News had a very nice piece about making major financial decisions as a single woman -- Sex and the City meets Personal Finance, which I thought was timely, and a way to use the movie as a segue into more sophisticated information about finances. I wish I had thought more about my finances as a young, single woman (who doesn't?)

Then there are the negative reactions. That Rude Girl calls the movie a two-hour-long advertisement, but then goes on to admit she recognized every name brand there -- including the sheets! Wow. I am soooo not aware of labels, at least not to that degree. I had to look up what a Manolo Blahnik was after I first watched the series (I watched them on DVD, as I've never been one to pay for HBO). BostonGal goes on to say that Sex and the City just isn't her kind of fairytale, and says a SEP IRA contribution would have been a better gift than the Louis Vuitton bag Carrie gave her assistant. I love BostonGals blog, and I read it nearly every day, but the more I thought about this comment, the more it fell into my "why young people ignore personal finance" bag. To give someone a gift like that is immensely practical, but for a woman in her twenties who loves fashion it would be like wrapping up a pair of practical wool socks as a gift -- nice, but not endearing. Nor would the gift of an IRA contribution teach the most essential skill -- contributing to the IRA oneself.

It's easy to look back and say, I shouldn't have done it this way. I spent $12,000 I didn't have in order to go abroad in college when I was 21 years old. Do I regret this? Yes, in a "I wish I didn't have to pay that money back" kind of way. But that trip sent ripples through my future that I simply can't regret -- it sent me to Japan, where I met my husband, changed my career path, and changed my life. You can't put a price on that.

In the quest for financial liberty, it's easy to lose balance. Sometimes a grand gesture is worth the money. Sometimes you have to take a vacation, or visit a sick friend or spend the money to attend a special occasion. Sometimes you really need to buy something you don't need, if you get my drift. That's all a part of being balanced. If we don't occasionally use our money for things that bring us pleasure, such as a gift or a thing of beauty, then why have it? It's easy to go too far to one side or the other; Scrooge was, after all, a bad guy for a good reason. I'm becoming more and more interested in the social and behavioral aspects of good money sense.

So much guilt, and love, and need is wrapped up in our money and what we do with it. A friend of mine whom I consider the paragon of austerity told me she owned a $750 Louis Vuitton bag that her British mother-in-law bought for her on Bond Street. Maybe this gesture was one of those grand gestures -- after all, my friend and her daughter nearly died working with refugees in dire conditions overseas -- and maybe it was her mother-in-law's way of saying, "I'm glad you're alive." Whatever the intent, my friend treasures her bag, and I don't think she wishes she'd gotten an IRA instead.

Who knows? Maybe in 20 years, she'll wish she had gotten that IRA after all. Having already escaped death once at age 30, however, I can understand my friend, and I can understand young women all over who focus on the now rather than the later. Life is short, and precious, and sometimes it seems best to enjoy the bag in hand.

"Yesterday is history. Tomorrow is a mystery. And today? Today is a gift. That's why we call it the present." ~Babatunde Olatunji

~And~

"Let the credit card companies market as they will, the only thing that's priceless is Now." ~Caleb Baylor Hive, 2005

Photos by Tolate2sk8 and Princess Poochie, respectively. Photos used with permission. For shoes, shoes, and more shoes, Princess Poochie's website can be found here.

Posted by

Missy

at

11:40 AM

0

comments

![]()

Thursday, June 5, 2008

Credit Card Companies -- They always, always win

We've been launched into summer (it's over 100 degrees in Tucson already) and our credit card debt is down to $6900. It is not the $5000 I had hoped for, but it is considerably less than the $24,000 I started at last summer. $17,100 less, to be exact.

Still, the interest we're paying on that $6900 in credit card debt is $50 a month. That's $15 for a cash withdrawal (huh? I don't even remember a cash withdrawal, but it must have been an overdraft from months and months ago) and $35 for regular interest. That's $50 we could spend on two nice items of clothing a month...or a gym membership...or we could put it aside in an IRA and have an extra $600 a year towards retirement. Oh, how the credit cards siphon money from people! From ME.

Here's an interesting article about credit card rewards:

About 85 percent of U.S. households participate in at least one rewards program, according to a study released Monday by Consumer Reports.And though rewards do spur consumers to spend more, the study found that confusing rules and restrictions make most reward cards more trouble than they're worth.

...

And while cash back, gas and grocery rewards credit cards can offer some relief for costly essential items, they often carry higher annual percentage rates than traditional credit cards, Consumer Reports said. Looking at some of the more generous credit card rewards programs, the study found that rates varied from 9.74% to as much as 19.99%.

We've gotten caught in the "points" game before, and have learned a hard lesson from it. I racked up nearly $7000 on my American Express card trying to get cash back; the cash back I got from last year (one single purchase was over $5500 -- I just read on my own blog that I used the card to get cash back from it) equaled $118.00. $118.00? Yes, that means I put over $10,000 on my card in order to get 1% cash back, paying who knows how much in interest (my monthly interest on credit card debt used to be almost $200). Credit card companies charge daily compounding interest, but that 1% cash back is a one-time annual bonus. It's like a $30 Christmas ham for the employee who makes $20,000 a year; it's a pat on the back, not real money or real help.

Here's a tip for beating the credit card companies -- don't use your card at all. Keep it for emergencies, and when you need to use it, pay it off immediately. They've always got an ace up their sleeve, and you just can't beat them at their own game.

The only way to truly get credit card rewards is by keeping your balance at zero.

Posted by

Missy

at

12:25 AM

1 comments

![]()

Thursday, May 29, 2008

How to keep saving money when life gets in the way

I've been reading some personal finance books lately (I'll review some of them here later on). There is no shortage of books on how to save, how to budget, invest, spend your money wisely, etc. What the books seem to lack, as a whole, is advice on difficult personal decisions.

This spring my marriage started to come apart. I was taken completely by surprise; my husband asked me for a divorce, and it was like a bolt out of the blue. I haven't written about it on this blog, because this blog isn't really to chronicle my personal troubles outside of financial decisions.

The problem is, divorce is a financial decision.

We talked, we went to counseling, but what really seemed to get my husband's attention was current divorce and personal property laws. I know my marriage isn't based on money, but the knowledge that we would have to sell our house in a down market, that up to 50% of his salary could go to child support, and that a divorce would bankrupt both of us was very sobering. I faced the fact that I would have to take a full-time job again and put my youngest child in daycare, and I started applying for jobs around the country.

More importantly, I made plans for my husband and I to separate. I would have left a few months ago, but I've been babysitting for a graduate student here and my leaving could have caused her to postpone graduating and getting her Ph.D. I couldn't let my emotional state cause her and her family financial hardship, so, I gritted my teeth and decided to stay until June.

Time eases all things. My husband and I have worked to solve some of our problems, and he no longer wants to get a divorce. Some things have remained, however, and one is my plan to leave in June. I no longer plan to leave for good, but I do plan to spend at least a month away. Part of that time I will stay with my parents, the other part with friends. It is an essential break that I think is necessary for me to continue my marriage. It is also a chance for me to network as I prepare to finish my master's degree next year.

All of this has been very hard to deal with, even as we have continued to pay off our debt.

I am incredibly proud of myself and my spouse, that we've stuck to our financial choices even as our personal lives have gotten more and more difficult. We had initially agreed to postpone travel for this year in order to save money, but which is better? Postpone travel and have an expensive divorce? Or pay the credit cards off a little more slowly while doing what is necessary to stay together?

Clearly, we've chosen the latter.

In addition to my travels north, my husband decided to ask his work to send him to Boston for a conference while we were gone. I know he is unhappy that I am leaving with the children for a month, so although I was initially irritated by his request to spend a week in Boston (after all, I'll be sleeping on the floor in my parents' house, not visiting fabulous historical spots in the beautiful Back Bay of Boston) I'm glad he's going.

This is at the crux of why it is so hard to eliminate debt and save money; life quite simply gets in the way.

Sometimes spouses need distance, and I know that right now I need my family and childhood friends to help me get through this. That doesn't mean I can't try to offset the costs of our travels; I hope to spend as little as possible and have some left over for the omnipresent credit cards when I return. I also hope that this time apart will continue to help my relationship with my husband because, after all, my marriage should last longer than my credit card debt.

Anyway, here's a few things we're doing to cut the costs of traveling:

- Shorter trips. I'm only planning my trip in 300-mile legs or less. This means I can drive more slowly, getting the best gas mileage possible.

- Camping, rather than staying in hotels. I'm camping in two national parks (possibly more) on the way up. I plan to buy the $80 annual National Park Pass; this gets me into the parks for free (usually $25 per park) and gives me a 50% discount on park campgrounds.

- Hostels to keep us showered. I initially planned camp all four days, but that is difficult to do in low desert and urban areas. In searching for campgrounds, I stumbled across Bootsnall.com which featured a couple of hostels in Salt Lake City, Utah. Once I'm sure of my dates, I can book a private room there for $47.00/night plus tax. That is a room with a private bath and it includes breakfast -- hard to beat! It also comes after two nights of camping, and I'm sure we'll be ready for a real bed and a hot shower by then.

- Freeze-dried food. I know this isn't the norm, but we had a failed 3-day backcountry hike a few years ago, and still have a ton of freeze-dried meals to show for it, along with a tiny camp stove and many cylinders of fuel. I plan to take this, along with a cooler of food, to help offset the cost of food on my slow trip north.

- Craigslist. My husband, rather than staying in a business hotel in Boston, has contacted a local resident who rents out a room in his house by the week; the total is less than half the cost of a hotel. We aren't sure whether this will actually work out, but we're keeping our fingers crossed. It means that he can use the rest of the money alotted to him by his work for some nice dinners and maybe a little sightseeing when he isn't working, without any out-of-pocket costs.

So, even by taking the extra days, I will still pay less than $80 for lodging each way -- about what I would pay for a single night in a hotel. I do have that initial outlay for the park pass, but I'm chalking that up to education expenses, as it will be a chance for my 6-year-old to explore geology, botany, and other educational opportunities available at national parks.

The picture I posted at the beginning of this article is one I took myself in 2004, when I took my son (then two years old) on a month-long trip to Canada. I'm sorry to say that we stayed in hotels every night, and ate primarily at restaurants, and I spent upwards of $5,000 for that trip. I have $1800 saved for my trip right now, and I think I can make it on less than $1000, but even if I don't, I certainly have learned a thing or two about cutting costs these past four years.

As my trip progresses, I'll post what works and what doesn't. Hopefully I'll get another great shot of the Grand Canyon at sunset again, for one-fifth the cost.

Posted by

Missy

at

1:04 PM

0

comments

![]()

Monday, May 19, 2008

Bought a diamond between January 1, 1994 and March 31, 2006?

A class action lawsuit against DeBeers for inflating diamond prices is being settled, and today is the last day to file a claim. Anyone can file a claim, and documentation isn't needed unless your purchase was over $10,000. Here's an article about the lawsuit at Consumerist.com; you can also go directly to the class action website here.

A class action lawsuit against DeBeers for inflating diamond prices is being settled, and today is the last day to file a claim. Anyone can file a claim, and documentation isn't needed unless your purchase was over $10,000. Here's an article about the lawsuit at Consumerist.com; you can also go directly to the class action website here.

I bought a diamond engagement ring in February 2006. We had bought gold wedding rings with engraving around the edge when we got married, but I later wished I had bought a more traditional ring, because I gained weight and it turned out the ring couldn't be resized. So, my husband bought me a beautiful diamond engagement ring for our 5th anniversary. Later, my 1-year-old daughter found the ring and toddled off with it -- I haven't seen it since -- for a loss of $800. We've searched the house repeatedly, and moving last summer it seemed sure to turn up, but it never did.

A few dollars in settlement isn't much of an exchange, but it's better than nothing...

Posted by

Missy

at

9:38 AM

0

comments

![]()

Thursday, May 15, 2008

A Belated April Net Worth

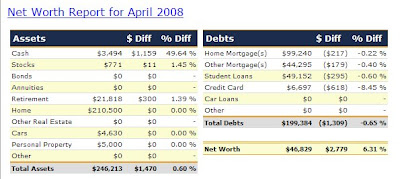

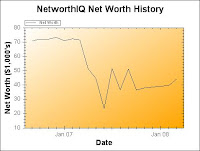

Our net worth is calculated, and we've done well, raising it by almost as much as a month's take-home salary, thanks to the tax rebate.

Our net worth is calculated, and we've done well, raising it by almost as much as a month's take-home salary, thanks to the tax rebate.

It's not quite fair to measure net worth in the middle of the month, since we've had 6 weeks to pay debt down rather than 4, but I still think we've done well. We saved our government rebate checks rather than using them to pay down credit card debt, a decision I still feel somewhat worried about, but I hope that the cushion can help us get through the summer and buy books for classes in the fall, as we usually don't budget enough for either.

I would have liked to use our checks (plus a little) to put $2000 extra on our cc debt, bringing it down to under $5000, but I'm planning to take a trip to see my parents this summer and I would have had to use our emergency fund in order to do that. Also, my husband's GI bill runs out in June, so we wanted a little extra cushion as we prepare to live with $750 less every month. I think we've done pretty well in trimming our expenses -- my sister is quite envious of our miniscule gas bill -- and I'm continuing to try to cut corners. It would be better for me to stay here the month of June, rather than visit my family, but it's important to my personal life right now that I take this time. It's also terribly hot and miserable here in June, and a good time to be somewhere cooler.

Hopefully we'll save a little money to offset the cost, since (I'll be shameless, here) my parents and my friends will foot the cost of water and cooling (my husband usually just closes the house up and turns the a/c off when we're gone). I'm also planning to camp as we drive north, rather than stay in hotels. It's cheaper and more fun for the kids, but the biggest appeal is health related; my daughter is allergic to a lot of the cleaners/bleach used in hotels, and gets terrible rashes from staying in them. By camping we can use our own things, get nice and dirty, and she can be itch-free (I hope). I'm not sure what we'll do for showers, but 3 days without a shower, while gross, isn't the end of the world either. I'll take a camp stove and a cooler of food, so we can barbecue our way to Idaho. That should save money as well.

My hope is that my stash of money won't dwindle too badly, and I can use it to pay down credit cards when I return. I know I'm taking a risk here, but I also don't want to use the credit cards. It's purely psychological, but saving money and paying down debt is a behavioral change and I think I will be more disciplined if I cannot use the card.

This month I would have met and exceeded my networth goal of $50,000 for this year (and it's only May!) if I included the change in the worth of our house. According to Zillow, our house has gone up $10,000. But, since real estate is so rocky right now, I am keeping the worth of our house at the same for the rest of the year. The dips and hills are so unpredictable I don't want it to mar the actual progress we are making on realized debt and savings.

Posted by

Missy

at

11:52 AM

0

comments

![]()

Monday, May 12, 2008

Scams, Shams and other Natural Enemies of Acquiring Wealth

I wrote this post as a comment on J.D.'s blog, Get Rich Slowly. He did a post on Multi-Level Marketing, and it really touched a nerve with me. After spending 45 minutes on my comment, I decided to make it into an actual post.

I started tracking personal finances last year, when I quit my job to be a stay-at-home mom. I had to do it; we just couldn’t make it otherwise. But, the other motivation was that I did not want to be like my parents. I am naturally cautious, so I haven't, up until now, gotten into the specifics of my family's financial follies. It still makes me nervous to talk about it, but I hope that it might warn others away.

My parents are really terrible with money, and they’ve always complained about being poor and in debt, but the truth is they have spent thousands of dollars in bad business ventures throughout my lifetime. They did Amway, Melaleuca (still do), some Rain Forest thing, and my mom sold MaryKay and Avon products. My mom started two real businesses that lasted only a day (a $10K loss each time) and has spent almost $20,000 on schooling to be:

Yet she doesn’t even have an associate’s degree — they were all certificate programs. And she barely made a profit as a realtor, because she is so shy, she can hardly talk to strangers at all!

The worst one she did was selling a fake “miracle” machine. You took a drop of blood, put it on a piece of paper, and FAXED it to them. Then they took crystals out, diagnosed you, and sent you the results. Of course, since the illnesses were fake, it was easy for the machine to “cure” them (most people were diagnosed with both cancer and AIDS/HIV). But they bilked people for $1800 a machine. A lot of these people were elderly and sick. And, though my mom made a lot of money in this venture (all under the table, I might add), she also lost a lot (she gave one woman alone $5000 for “off-shore stocks,” without getting even a receipt, let alone a stock certificate).

I was overseas for much of this one, but when I got home and realized what was happening, I called the cops on the company - the attorney general’s office was searching for their base of operations, and the local news had done an expose on the scheme. I told my parents I had notified the police (before they raided, I might add, but my mom still refused to accept it was illegal), and luckily my mom fell and twisted her ankle and couldn’t go to work the day the police came, or she might have done time. I have never seen my father more furious with me in my entire life, though, than when I told him I had called the cops on the operation. He just couldn’t see what was happening — to him, it was his “last chance” to get the easy life, never mind the morals. For myself, it was one of my lowest points; I was terribly disappointed in both my parents.

My parents are 58 and 62 now, and they’ve finally seen the light and are going to a real financial counselor. They are saving money, investing in index funds, and paying off debt. The sad thing is that, even though they’ve found what works, they have less than $10,000 saved for retirement, with my father only 7 years away from retiring.

Don't fall for the schemes. As J.D. writes in his post (it is the name of his blog, after all), it's better to Get Rich Slowly. And that, I'm sorry to say, is the truth of the matter.

Posted by

Missy

at

2:51 PM

0

comments

![]()

The Politics of Reality: Driving 10 mph slower saves more than repealing the Federal gas tax

I always enjoy perception versus reality problems, although sometimes they make me sad, too (see this story about how "clean" biofuels are causing more environmental devastation than the Exxon spill). But, I also enjoy watching politicians squirm, and this great calculator from the NY Times shows how much you spend on gas per trip.

Using the calculator, you can see how much you'd save by having your tires properly inflated, by driving 10 mph slower, or by having the Federal Gas Tax repealed. If you click on "Drives 65 mph instead of 55 mph" and "Repeal Federal Gas Tax," you can see that driving just 10 mph faster negates any savings you might get from repealing the tax. Very revealing, I think.

I highly recommend the article it came from, too; I know that we've been spending our weekends biking the kids around town, rather than driving up to the mountains like we used to, in order to cut our costs.

Of course, our commuting now is with the 167cc scooter, and I can't tell you how smug my husband is everytime he has to fill up. "I haven't filled up for two weeks," he said last weekend, "And filling up today cost me $5.67." We took a gamble by selling the station wagon and buying the scooter (the scooter cost twice as much), but we're saving over $65-120 a month just in gas, and about $600 a year in maintenance and $500 in insurance. It looks like that scooter will pay for itself in another year or so, and I have to say -- thinking about that makes me slightly less tired than usual.

Posted by

Missy

at

2:37 PM

0

comments

![]()

Sunday, April 6, 2008

My Newest Venture: Index Funds

I'm hoping to start putting a small amount of money -- say, $15-20 a paycheck -- toward a Roth IRA and invest it in an index fund. My current investments have really taught me the art of tolerance; the markets went up and my stock funds went from $1000 to $1400 in just a few months. Then the market went down, and my stocks -- mostly in solar and renewable energies -- also plunged, finally stopping at $605. I was feeling a bit panicky, and wishing I hadn't followed the advice of financial magazines (and really, I shouldn't have -- I was picking my stocks on P/E ratios, but there were a couple "big performers" that the magazines were touting, so I bought them -- and lost big.)

However, when I looked over my purchases, I decided that only one stock was an "unknown." It was stock I had bought for sentimental reasons without really scrutinizing the business practices of the company (it was near my hometown). So, I cut it loose. It was a good thing, because the stock has continued to drop, and I lost relatively little.

My stocks just surged back up to $825, and from this I've learned: thou shalt not check the stocks every day. I trust the companies I've invested in and so long as they don't go under, I know the stocks will eventually perform.

Now I am beginning to research the much-touted index funds. I've discovered the Vanguard 500, and today I saw this article on a new Vanguard Index fund that follows mid- and large-cap companies in the FTSE All-World Index. I'm also trying to follow and understand securities. At some point, I'd like to take a class; I never learned anything about finance either in high school, college, or now, having gone through most of a master's degree. It's kind of an adventure, really, except that I feel pretty stupid a lot. So I'll be posting more about Index Funds as time goes on, as well as continuing to discuss debt paydowns.

Posted by

Missy

at

7:18 PM

0

comments

![]()

Congrats to Budgeting Babe

Congrats to Budgeting Babe, who aired in this piece on CBS:

Posted by

Missy

at

8:31 AM

0

comments

![]()

Friday, April 4, 2008

Net Worth for March

As predicted, we have a positive move on our net worth for this month, going from $39,686 to 44,050, which is an increase of $4,364 for this month. This is almost entirely due to the paydown of our credit cards; we are down to a single card now.

This month we should have a positive increase also, as we continue to save and pay down our cards, but this summer we'll have to really tighten our belts.

Posted by

Missy

at

1:58 PM

0

comments

![]()

Wednesday, March 26, 2008

Fantastic Post about Living with Children

If you read this blog much, you may notice that I tend to rant about the perception of single people and DINKS (double-income-no-kids) couples about the reality, financial or otherwise, of living with children. It is rare that I find a post I think is really great; there was a fairly decent guest post on Get Rich Slowly called How To Prepare For A Baby Without Going Broke. There were some simple things to do, like buying used baby clothes and furniture, and borrowing from friends. It also advised breastfeeding (I breastfed both my kids and it is considerably cheaper, even with the purchase of a $250 breast pump). It recommends cloth diapering, although most cost calculators find that people tend to break even once washing (hot water is a must for a load of diapers) and the cost of the cloth diapers and diaper covers is included. We ran those calculations ourselves, and finally switched to disposables after a few months of torture, because water is at such a premium in the southwest.

What tends to bother me is the "pollyanna" attitude so many people take; the reality is that even a used crib (I was recently shopping for one for a refugee family here in Tucson) runs $75-$100. That doesn't include a mattress ($50 and up) or blankets and sheets. So even someone who buys used can expect to spend $175-$200 for a crib, and parents must be careful not to get an older crib because they can be dangerous, even fatal, for infants (their little bodies slip through the slats, which are made too big, their heads get caught and they can hang themselves). So yes, buying used can save you money, so long as you are very careful, and watch the recalls and safety issues related to used goods.

Parenting, really, is an issue of preparation; if you know what's coming, you can be ready. The most important thing to do is to be stable financially before you even get pregnant. Someone who has at least a year at the same job, very little debt and is done with school is in the best state, financially, to handle pregnancy and children without incurring bankruptcy or undue stress. That doesn't make parenting perfect -- it just makes it easier.

However, when I read this post called 25 Ways to Simplify Your Life with Kids, for the first time in a long time I felt someone "got" what it meant to parent.

Anyone who has kids knows that any life with kids is going to be complicated, at least to some degree. From extra laundry to bathing and cooking and shopping and driving and school and chores and crises and sports and dance and toys and tantrums, there is no shortage of complications.

You won’t get to ultra-simple if your life includes children … but you can find ways to simplify, no matter how many kids you have.

Take my life, for example: I have a house full of kids, and yet I’ve found ways to streamline my life, to find peace and happiness among the chaos. How is this magic trick accomplished? Nothing magical, actually, but just little things that have simplified my life over the years.

The main magic trick, however: making my family my top priority, and choosing only a small number of priorities in my life. If you have too many things you want to do, or need to do, your life will become complicated. But if you choose just a few things that are important to you, you can eliminate the rest, and simplify your life greatly.

The author goes on to list some really wonderful ways to enjoy your life as a parent, and these things also reduce costs over time. For example, cooking and cleaning with your kids reduces your tendency to eat out (or hire a housekeeper) and also provides learning time for the kids. Not over-scheduling also means not spending extra money on "activities" that may or may not be useful (a friend confessed that she spent $250 for a 6-week kinder-music course -- ouch!). My favorite tip, though, is the last one -- "Focus on Doing, not Spending." Not only do you save money this way, it also communicates something to your kids -- that love isn't about dollars.

And that, to me, just makes sense. Thanks to Zen Habits for the best post about families I've seen in a long time.

Posted by

Missy

at

8:32 AM

0

comments

![]()

Friday, March 14, 2008

$4000 more on our credit cards

We got our tax refund back, and that combined with a little extra went towards paying off another credit card. We have a little more money coming and should be able to put another $2K on the credit cards next month, so I am very happy with our debt reduction. Since we are working against a deadline in May -- we'll lose $750/month in income then -- I'm hoping to have our credit card debt down to "manageable" if not "gone." We will just have one card with a balance after this week. I will adjust the bars to the left so everyone can see our progress.

We got our tax refund back, and that combined with a little extra went towards paying off another credit card. We have a little more money coming and should be able to put another $2K on the credit cards next month, so I am very happy with our debt reduction. Since we are working against a deadline in May -- we'll lose $750/month in income then -- I'm hoping to have our credit card debt down to "manageable" if not "gone." We will just have one card with a balance after this week. I will adjust the bars to the left so everyone can see our progress.

We went ahead and spent $250 of our refund on a new iTouch for my husband; he's been collecting gift cards since last fall, and had over a third saved that way. Since he's been diligently saving in a savings account, and because we've been paying things off steadily, we agreed to make this purchase. He's a tech-head and has used his iPod of 3 years ago nearly every day and it's getting pretty old and delicate (when I set it down, it turns itself on, etc.). Plus, it means a lot to him. It's important to me to pay off the debt, but it's also important to let him have some cool stuff every now and then. I can hardly get him out of holey t-shirts and khaki shorts from the used clothing store, so it isn't as if he is a spendthrift in other ways.

I'm bringing in $400/month now babysitting and this month we'll pull in around $250 for the guesthouse, so that income is relatively steady. I'd like the guesthouse to be rented out more, but I'm giving it some time. I may start looking for more advertising venues; so far I've limited myself to "free," but I may be able to find some really low-cost things to do as well. I'm considering buying a domain and building a website for it also -- maybe a good project for summer, which is off-season here.

It's amazing how much cutting our monthly expenses -- $40 here, $60 there -- really helps. I don't feel nearly as stretched financially as I was just last fall, and we had more money coming in every month then.

Posted by

Missy

at

10:17 AM

0

comments

![]()

Thursday, March 6, 2008

We sold the car! $1500 more towards paying off our credit card

We finally sold the Volvo wagon yesterday, after a harrowing two days of last-minute fixes. I cracked the valve cover trying to change the valve cover gasket (gasket = .01 pounds of rubber and cardboard, valve cover = 2 lbs of metal). Luckily I found a used one, flirted with the guy at the counter and he gave me the cover for $10 instead of the $45 quoted price. Sometimes it pays to be a female who fixes cars... (not usually, though, just for the record).

So, we got $2100 for the car, and I used most of the money to pay off bills, although we've earmarked $150 for a good tune-up on our remaining car, and we are putting $1500 on credit cards.

Debt snowball, here we come!

Posted by

Missy

at

12:04 PM

0

comments

![]()

Thursday, February 28, 2008

Lessons I've Learned from Being Broke

This article in Kiplinger made me start to reflect on my own life and the times when I was happiest. Ironically, the times when I had the least amount of "things" in my life were some of my happiest times. One of the things I can't explain to my husband is that right now, even though we don't have a lot of extra money, I feel rich. I own a home. I have two kids that I adore. We can afford to have birthday parties, go out for dinner and buy clothes that fit. For someone who grew up without being able to afford to either attend or have a birthday party (my mom wouldn't let me go because we couldn't afford a gift), throwing my son a party at the Children's Museum in Tucson made me very happy. We might have a crumby car, and my husband might have to save up for his iTouch, and maybe I make things from scratch during the week so we can have that Sunday morning breakfast at our favorite breakfast place, but the more I downsize and get rid of "stuff," the happier I feel.

Very un-American, isn't it? At least, what with all the newspapers and t.v. media encouraging us to spend our way out of a recession.

Here are the highlights from this article, which I found very interesting.

1. Know your priorities.

2. Debt is a vampire.

3. Have a cushion to fall back on.

4. Set goals and tune out peer pressure.

5. Small sacrifices add up to big rewards.

6. The size of my bank account doesn't matter.

My favorite quote from the article: "I remember my dad telling me that the only things worth going into debt for were those that appreciated in value: a home and an education. Anything else will suck you dry. Lesson learned."

Posted by

Missy

at

12:02 PM

0

comments

![]()

Quote of the Week

This is from a comment on Get Rich Slowly by Catherine on downsizing your life:

"I don’t want to be rich, I want to be free. And freedom is worth more than stuff."

Posted by

Missy

at

11:10 AM

0

comments

![]()

Credit card debt down another $1000

With the extra money coming in this month, we were able to put another $1000 on our credit card debt. We also put extra toward my student loans and toward the mortgage. We are slowly paying things down, and I'm looking forward to adding up net worth for February!

Here's a few things we did this month to further reduce our cost of living:

*I pulled out our old bread machine and started making my own bread. At 86 cents a loaf, I can make whole wheat, all-organic bread for 1/5 of the cost of buying it at the store.

*I started making things in bulk. I made homemade macaroni and cheese, which seemed more expensive at the time (about $8 in ingredients), but one recipe made a giant pan and it lasted for several meals. I also made pinto beans from dry beans -- 3 lbs of dry beans = $2.00. My kids absolutely love refried beans, beans and eggs, beans and quesadillas...you get the point. Since I make the beans myself, I get to control what goes in them. I put 2 strips of bacon in the entire pot, and the bacon flavor...mmmmm. And instead of one person eating 2 strips of bacon for breakfast, we ate the "taste" of the bacon in the beans for over a week. This saved money AND was better for us. (tip: I froze pints of beans, which were enough for about 2 meals. This kept them fresh, and the freezing actually makes the beans better for refrying.)

*I started making my son's lunches for school. This week I made him a lunch 3 days out of 4, and not only was he thrilled, he got fresh bread, fresh fruit and a healthy snack of root vegetable chips instead of his usual lunch at school -- pizza, pre-made bean burritos or a hotdog. I also put a note in his lunch, which made him really happy.

*I tried to get by on as little as possible. When I went to the grocery store, I stuck to fresh foods and bulk items. I found that, when I avoided the doomsday aisles of chips, crackers and juices, I could get everything I needed for under $50 a trip, or for around $100/week. This worked even at Trader Joe's.

*I bought in bulk from Amazon.com. This helped alleviate the costs of dry goods items like diapers and paper towels, and it allowed me to buy unbleached, recycled products like 7th generation. I didn't know at first if it would really reduce our total costs, but it truly has.

*I cancelled our YMCA membership. This was hard to do, but I have to go at least 10 times in a month to justify the $60 monthly cost, and it wasn't happening. I did use it last fall, when I went to Pilates 3x a week (and I loved the class!), but the nursery uses bleach and it made my daughter break out a lot afterwards, so I finally stopped going. I can still use the Y for $6-8/day, depending on which one I go to, but it was hard to give up the membership. However, $60/month was a pretty big expense -- $720/year. It is more than the insurance on our Volvo, and we're selling the car so we won't have to pay that expense, so I decided it had to be.

Those are some of the things I've done the last 6 weeks to try to save money, and it really has worked. It is surprising how the small things make a difference, and even more surprising how your attitude changes. I "treated" myself to a lunch at Barnes & Noble, and I was terribly disappointed in my $6 half-sandwich that was overcooked and drowning in cheap Italian dressing. The kids got a cookie, and for $1.95 I expected a good cookie, but it was stale and tasteless, and I thought, how their quality has gone down! But then I realized that the cafe has not changed -- I've changed. Making my food from scratch, and realizing the actual cost of a thing has changed how I look at things.

We are waiting on a possible buyer for the Volvo, so that, combined with (hopefully!) a tax return could pay off a pretty big chunk of debt. I'm feeling good about our 'debt snowball' at this point; next stop, reducing our energy bills.

Posted by

Missy

at

10:01 AM

0

comments

![]()

Saturday, February 23, 2008

The Month Of February: Success!

This month we rented out our guesthouse by the week and made $450 ($100 more than monthly rental). We would have made another $80 but there was some confusion on the dates. That amount, combined with the $256 I made doing some light babysitting, brought my salary this month to $706, or roughly twice what I brought home when I worked part-time at a real job (after daycare).

The hardest part is not knowing what next month will bring, but hopefully more renters. We had a great experience this month and hope it will continue.

Posted by

Missy

at

6:36 AM

0

comments

![]()

Thursday, January 31, 2008

Fixed Costs Continue to Rise

I've recently begun to address some of our fixed costs to try to pare them down as much as possible.

I've recently begun to address some of our fixed costs to try to pare them down as much as possible.

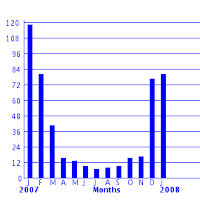

Unfortunately, it seems that we are fighting a losing battle -- all our efforts have merely kept us in the same place we were a year ago. The chart at the top shows our monthly gas usage for the past year; even though we used about 2/3 the amount of gas for the month of January 2008 than we did for January 2007, it cost us a third more. Our gas bill, which usually runs around $85/month in the wintertime (we live in Tucson and keep the heat around 64 degrees in winter), shot up to $144, 169% of last year's cost. We cut our use by about a third by buying gas-efficient appliances and turning the heat down as much as possible, but we are paying about 2/3 more -- which means the cost of natural gas has doubled in Tucson. This is unbelievably frustrating! Although I suppose, on the brighter side, that it could be worse; if we hadn't upgraded, we'd be paying well over $200/month for gas this winter, which is unheard of in Tucson (our house is only 1200 square feet and we have a brand-new furnace and new gas stove). We usually save money on utilities in winter here, so it's especially hard.

Whether or not this is fuel-related I don't know, but the cost of groceries in Tucson has also skyrocketed. We buy healthy, whole grain bread and usually I don't balk at the cost -- about $2.99/loaf. I tried making the same in a bread maker a few years ago and found I hardly saved any money doing it, and if I counted all the loaves I messed up, well...I was losing a bit in the process. I noticed that my bread went up to $3.29 this summer, which is high but not horrible. Then, just last week, I went to the grocery store and my bread is now $4.29 a loaf! That's a 143% markup in just six months!

This comes just after I started using the Amazon Subscribe and Save Program. Basically, if I order an item to be routinely delivered, I get free shipping plus 20% off. I can choose 1, 2, 3 or 6 month intervals. Since my daughter has extremely sensitive skin, I can't buy a lot of regular soaps or diapers, and it's been killing me to spend $12/pack for non-chlorine diapers when the regular cost $9/pack for about 1 1/2 times as many. I pay close to double; fortunately, the "hippy diapers," as we like to call them, are close to the same price if I buy them in bulk via Amazon. Unfortunately, our savings here are going to pay our expanding grocery bill in other areas. I'm not sure what to do about this, except that maybe it's time to renew that Costco membership and start shopping on the other side of town again.

I will be pulling out the bread machine again. If I can still make a loaf of multi-grain bread for $3, I can save myself over a dollar a loaf now. Other staples have gone up as well. Maybe it's time to pull out my Japanese cookbook and switch to rice?

What are you doing to save money this winter? Leave a comment and share! I need all the help I can get. :)

Posted by

Missy

at

11:08 AM

0

comments

![]()

Monday, January 28, 2008

Extra Cash -- How To Earn More and Spend Less As A Family (Part 2)

You know, I've spent several days really considering what I wanted to write in this post. After all, this is it; this is why I'm writing this blog, to talk about what it takes to save money as a family and how to avoid the pitfalls. Meanwhile, I'm trying, myself, to save money and avoid pitfalls.

In my first post about this, I talked about how truly difficult it can be to have both parents working without one or both taking on a second job. The cost of babysitters or childcare is a big problem. For those with family nearby who will watch the kids for free, well, I wish I were you. But for the rest of us whose family is in another city or state (or country), there are other issues to consider.

But I see the hole in my story, and actually it is the first thing we did when I started working, so it is my first piece of advice.

1. Stagger your hours. If you can work evenings and your spouse can work days, then you can trade off watching the kid(s). Most parents do this at some point or another, and my spouse and I traded off for nearly three years. Pitfalls include:

- One parent who feels insecure about watching a very small child, or overwhelmed watching two or three. This sounds a bit silly, but the first time my husband left me alone with our first-born, who was two weeks old, I was terrified. Some families leave the role of watching young children to the mother, and the father may feel ill-prepared. Word of advice: get over it. And men? Never use the term "babysitting" when you're watching your own child. Please!

- Stress on your marriage. I worked Saturdays, all day -- for three years. Even when Saturday was the only day I worked, it was hard not having a whole weekend with my spouse. We rarely got to do things as a family. It wasn't as bad when I worked nights, for some reason, probably because I worked a swing shift and was home by 9:30 p.m., but the Saturdays killed me. That being said, it can be done, but maybe not for too long -- after all, divorce is expensive too.

Despite the problems, this is the easiest strategy for most families. After all, your kids are with a loving parent, they are home, and the care is free. Even if your children go to daycare, there are really good reasons to limit their time there, and with 2 working parents, staggered hours are the best way to do it.

My next solution for families in financial trouble is really over-the-top. It is controversial, and I would hesitate to talk about it except that it just simply needs to be brought up.

2. Have one parent quit working.

If you want to earn more and spend less, and you have small children, don't get a 2nd job -- quit the one you have. Really. Particularly for lower- to middle-class families, that second job might pay for a nicer car, but most of the money will go to childcare, emergency take-out dinners and the required niceties for work (dress pants, leather shoes, etc.) Take home pay ends up being quite small; you also miss all the milestones your children go through (first steps, first words, etc.).

Quitting work doesn't mean the same thing as giving up your career. Maybe you want to finish up a bachelor's degree, or work on a master's degree. You can keep up with your former co-workers by dropping in to chat occasionally. A lot of studies show that women (I don't know of any studies regarding men) who leave the workforce have a hard time re-entering - if they re-enter with the same, old set of skills they had when they left. Taking a class is a minor expense and can be crucial to keeping your working skills sharp for when those childcare expenses drop (the older the child, the cheaper the care).

I know there is a "culture" of stay-at-home moms (SAHMs) and working moms, and the media love to play off of the culture war. I personally was a part of a "mommy group" and was irritated when they considered me a working mother (the connotation was negative) -- I worked 6 hours a week on Saturdays, and my husband was with our son the entire time -- but this kind of either/or attitude was and is simply ridiculous. I actually dropped out of the group, the prejudice among them was so strong -- they were all "devoted SAHMs" who had given up their jobs deliberately. I know that writing about the financial aspects of this just plays into the hands of these helicopter-mom types, but please note I didn't say mom should stay at home -- I said parent. I know several stay-at-home dads and my husband and I have traded off over the past 5 years; sometimes I worked part-time and he worked full-time, sometimes it was reversed. It's just good to be flexible about this as a family (for a good read, try The Two-Income Trap by Warren and Tyaqi).

(Side note: A lot of people don't realize that the FMLA, or Family and Medical Leave Act, covers fathers as well as mothers. Dads are guaranteed 12 weeks of unpaid leave after the birth of a child. My husband and I staggered ours, keeping our daughter out of care for almost 6 months. I had short-term disability insurance and received 75% pay for 8 weeks; my husband's boss asked his co-workers to "donate" leave so he got three months at home with full pay. It was the best money we've ever made!)

3. Be creative with your job. This can mean asking your boss if you can bring your child or children to work with you (this complicates if you have more than one, and is hard around the toddler stage). I was surprised to find that the affluent non-profit I worked for in Washington, D.C. was fine with me bringing my son (he cried during a call to the Undersecretary of State -- I was mortified) while the children's section of a library I worked at not only did not let me bring my children, they tried to ban them from the area if I was there (I threatened to quit -- after all, it was a public area). You never know who will be flexible -- and who won't. Here are some other job ideas:

- Work at home. You might be surprised that I didn't suggest this before I suggested one spouse quit, but that's because most studies show that a parent who works at home has very little time to watch their children, and they are better off in childcare with all the accompanying ABCs and art projects. However, it can be cheaper to find someone to au pair or watch the children while you are present. Working at home during off-hours is really the best option, both mentally and financially, but we've never been able to swing it. I think this option sounds better than it actually is in practice; most people I know end up needing to put their children in childcare, at least part-time, in order to do well working at home.

- Involve your children in your job. This, of course, very much depends on the job. Sometimes children can be taken along. Other jobs naturally involve your children; I worked at my son's preschool as a substitute for a while. He got 50% off tuition and I got a small wage. While I only made $7/hour, once I added the tuition break to my wage, it bumped it up to $10.75-$13/hour. It wasn't a great amount, but I could come to work when I wanted, and I received a lot of free training about discipline and child development.

4. Be creative with your non-job. Some of these ideas work for really ambitious working parents, too.

- Turn a hobby into money. This can be small or big; sell your creations on Etsy, like this person, or start your own business. A friend of mine was an avid fisherman; now he owns a little fishing gear business, employs his father, and his kids (aged 9 and 12) help out. He even hires my dad to fix boats for him.

- Watch someone else's kids. I just started watching an 11-month-old baby for $8/hour. Since my daughter and the baby just play together, this is up on my list of easiest jobs. The only drawbacks are all the laundry I get done while sitting on the floor, playing with them (wait, did I say drawback?)

- Fix stuff. A stay-at-home dad I know fixes people's computers and does small carpentry jobs for extra cash. A mom I know is a licensed hairstylist; she goes to people's homes (particularly the elderly who don't drive, or shut-ins) and does their hair.

- Be creative with your property. BostonGal rents out her basement; we are in the process of turning our guesthouse into a vacation rental.

- Join a food co-op. This is just another way to turn a hobby (gardening) into money, by selling your vegetables.

- Blog. I am waiting for this to work out. Still...waiting....

There are many ways to make extra money as a family, even if the difficulties of finding childcare are ever present. For the lucky, a flexible job can allow extra time for hobbies, making homemade food (cheaper) and still fitting in trips to the park. For everyone else, some life changes may be in order.

That's what kids do; they change your life. Those who try to avoid it fight a losing battle. Best to move on, cut back on costs, and occasionally remind your senator that daycare still costs more than a university education.

Posted by

Missy

at

12:44 PM

0

comments

![]()

Monday, January 21, 2008

I'm Not Crazy

Here's an article, appropriately named The Childcare Crisis, about childcare costs that show that I was actually underestimating the cost of childcare in an urban area when I quoted $1800/month:

Wendy Brauner's rent clocks in at $1,800 a month -- what some might consider a great deal in San Francisco. But don't think Brauner is living the high life. With a son, 3, and another almost 6, she was spending $2,750 a month on child care until her oldest started kindergarten last fall -- nearly 20% of her household income.

"I was writing a check for $17,000 to the preschool and wondered why it sounded so familiar," she says. "Then I realized it was a few hundred off what I paid for my first semester of college at Wellesley. It's just an enormous outlay."

I get that. Even with just one child, child-care costs were a major chunk of my own family's monthly expenses until our daughter, Harper, started kindergarten. The tab never came close to the $3,200 a month we spend for shelter, but that was mostly because, as a freelance writer, I can shuffle my work hours as needed. And that saves money -- a lot of money. In part-time day care, Harper never cost us more than $900 a month.

Still, it's a serious budget item. And we're among the lucky ones. The cost of child care in this country is one of those little secrets -- like leaky diapers and colic -- that parents just don't share with friends who are expecting.

Posted by

Missy

at

1:22 PM

0

comments

![]()

Sunday, January 20, 2008

Extra Cash -- How To Earn More and Spend Less As A Family (Part 1)

One of the problems that couples with children face is the extreme cost of childcare. This interferes with a family's finances in ways couples without children (or Double Income No Kids -- DINKs) never have to face. I am always slightly amused and irritated by financial experts who recommend a 2nd or 3rd job to people in debt, because this kind of plan actually sinks a family with children further into debt. Here's why:

- Kids require more than just daycare -- that cost is straightforward. Let's just say you have your child in daycare, and the daycare center is open 7 a.m. to 6 p.m. (standard hours) and you can leave your child there that entire time for a set cost -- say $450/month, which is middle of the range for Tucson. An extra job is after hours. This means that you must find a sitter for those hours, and we've never managed to find someone to babysit for us for under $7/hour, and that's dirt cheap. I remember babysitting as a teen to the tune of $2-3/hour, but trust me -- those golden days are over. First of all, it is now illegal to leave your child with anyone under the age of 13 (I babysat for extra money at 11 and 12 years old). Second, kids are simply more saavy these days, and they ask for more. We usually don't use high school aged sitters, however, because our kids are so small, and college kids don't go for less than minimum wage, but even the few times we let a high school kid watch our son (before we had 2) we still paid $6/hour and stressed about it the entire time.

- Anyway, so if you take on a 2nd job, say from 5 p.m. to 8 p.m., you will pay $21+ for a sitter. Then there is dinner. A couple without kids might get away with a sandwich eaten over the sink, but kids need nutrition. But just for fun, let's say you go the cheap route -- .89/box macaroni. Watch to see how much that costs you.

- Kids need attention, and that means you, not the sitter, not the minimum-wage-earning daycare worker, but you.Parents who are away from their children for great lengths of time tend to spend more on their kids to make up for it. It is very, very difficult to resist this urge. After a long workweek, who wants to fight with a child in the middle of Target over a 99 cent toy? It's only a dollar, really, but it's just that sort of thing that adds up over time.

- Next, parents who work long hours and must put their children in excessive care (most daycares have a limit of 10 hours a day, so excessive is anything over that) find that their children have behavioral problems. When my husband and I had our son in daycare full-time (about 40 hours/week, or four 10-hour days), we found that most of our time at home consisted of disciplining our son. Instead of being able to enjoy our weekend, we had to enforce rules that the minimum-wage-earning daycare worker didn't. We have well-behaved children; we are not much for corporal punishment, but time-outs, early bedtimes and long talks about listening filled our weekends. This is not a solitary experience; several studies have shown that a lot of daycare = more difficult children. Parents who don't enforce the rules on the weekends experience other problems, such as injuries, that happen when kids are out of control. Even the co-pay on an emergency room visit is expensive.

Ok, so your kid is in daycare, you have a good sitter and you found a second job for both parents, with a combined extra income of $22/hour minus your sitter. You're finally getting ahead a little, although the kids are slightly misbehaving and living on macaroni and cheese dinners. You take off a little time for that checkup with the doctor, and find that your child has high cholesterol and it's exacerbating his/her asthma. Co-pays on the meds are over $50/month, and that's just the beginning.

Kids need proper nutrition. Give a kid sugar cereal for breakfast, cafeteria food for lunch and a mac-n-cheese dinner, and you get the following problems:

- Childhood Obesity

- Early onset of type II diabetes (check any newspaper to see diabetes skyrocketing in young children)

- ADD/ADHD and other disorders (sometimes but not always linked to diet)

- Lead Poisoning (yes, an iron deficiency leads to lead poisoning, which retards childhood development and requires therapy, nutrition intervention, and a whole host of other things that translate into even higher costs).

- Heart disease, kidney disease, high cholesterol and high blood pressure

Sound depressing? It is. The main thing children need from their parents is the one thing hard to give -- time. No amount of extra cash will make up for a parents time. Even a parent working just a regular full-time job will find it hard to meet the needs of a single child in the hours remaining. One responsible adult in the family needs to be around to make meals and/or lunches, spend time helping with homework (school age) or playing and reading stories (little ones). If both parents are working, and at least one has a lot of energy, it is possible to make this work, so long as both parents are trying. If one has a flexible job, that's even better. But add a second job to one parent, and you invite exhaustion and illness in the adult, and you may even risk the future of your child.

So, for a family in debt, what are the options?

Posted by

Missy

at

11:56 AM

0

comments

![]()

Wednesday, January 16, 2008

Want Solar? Move Now!

One of my favorite PF Bloggers, BostonGal, recently unveiled her large purchase for 2008: solar panels for her house. I was pleased to read about her choice. One reason I enjoy her blog is that she tends to take the long view, and by long, I mean looonnnngggg, as in 30 years long. A lot of people commented that solar panels was a frivolous purchase, which surprised me, because solar panels cut energy costs for years and years. For someone like BostonGal, who consistently tries to cut her fixed expenses, a purchase that will pay off in 10 years and lower her cost of living then, if not now, makes perfect sense.

Anyway, in another display of utter senselessness, Congress has passed an energy bill that is unfavorable to solar energy. With energy independence in the forefront of so many people's minds, this kind of choice makes me shake my head and hold up my hands in disbelief. I tend not to talk politics in this blog -- it is about personal finance, after all -- but it does frustrate me to see bills that make energy improvements more difficult for homeowners. Last but not least, I invested in solar power, and after the bill's announcement I was puzzled to see one of my solar stocks (SunPower) plunge by about 30% (the other one, ironically, was less favorable according to the finance experts and it continues to hold steady gains). I knew SunPower had a high price to earnings ratio, and I hesitated because of this (SunPower's P/E ratio is 477; Evergreen Solar's P/E ratio was about 12 when I purchased it, although it is currently unavailable), but the herd mentality took over eventually and I bought a small amount of SPWR stock.

So, if you look at the article, you see that subsidies for solar power will expire in 2008, so BostonGal is ahead of the curve yet again. I just wish we had started watching our finances earlier; if we had, we could be installing our panels right now, too! All I can do is watch and hope that Congress, with the pressure of an election coming, acts to extend subsidies to solar. (Some people think the drawing back of solar subsidies is a good thing; see BostonGal's post on that here.)

Energy Bill Troubles Solar Industry

NEW YORK -The omission of renewed investment tax credits for solar energy in the wide-sweeping energy bill signed by President Bush late last month has put the future health of the U.S. solar power industry in question.

The bill includes more stringent mandates for fuel economy and energy efficiency, but it doesn't extend the investment tax credit for companies specializing in solar power systems. That credit, which amounts to 30 percent of the value of qualified residential or commercial solar equipment, is set to revert to 10 percent at the end of 2008 unless it is extended.

Posted by

Missy

at

9:40 AM

0

comments

![]()

The Coffee Shop Around The Corner, Part Two (The Fight)

"Anyone can start a business. You could too, you know." Of course, I did what anyone would do -- I started dreaming again. I could see the coffee shop, with a little section for kids to play in, and with the little shelf of author-signed books for sale. I could see the art on the wall, and the bags of coffee, and the cookies on the counter. And I made the mistake of opening my mouth to talk about it.

I am, in some sense, a practical person, as I mentioned before, and I am aware of the failure rate of businesses. I am aware of the fact that espresso bars are not exactly new material, and that I can go to any Barnes & Noble and get a cup of coffee and browse about a thousand books if I feel like it. I know that. But I can't help my heart dreaming about it, right? It just does.

My husband, not surprisingly, says very little, but I feel the tension in the air (my mother has started and lost two businesses). And I say, "I don't plan to run out and try this tomorrow, but it's one reason I started the personal finance blog. If we can pay off our debts, and save some money -- if I can prove to myself that I am responsible enough to do those things, and to do them slowly and systematically -- then, and only then, would I look into writing up a business plan and seeing what might come of it." My husband is silent. The minutes go by. Then he says, "You do know most businesses fail within their first year?" Silence descends.

Then the fighting started. I argued that I was smart enough to know businesses failed, thank you very much, and all I wanted was him to respect the fact that I was capable of doing such a thing, that the one thing that would make me consider divorce is the constant squashing of my ideas. He argued that he couldn't be expected to agree and support all my crazy ideas, because so many of them were improbable. I pointed out that my entire life had been improbable, from going to university to flying to a remote Japanese island and learning the language in a year, running my first marathon, marrying him and having two kids! Moving cross-country! Traveling 5,000 miles with an infant and a 5-year-old! I do six improbable things before breakfast!

Silence.

Then I dropped the big one. After all, I say, I gave up a lot to get married. I will never travel again, not like I'd hoped to. I can't skip off to any interesting job I want. I am, for all intents and purposes, trapped here. So why must I also trap my mind? Can't my mind, at the very least, be free to travel to improbable places? Spend improbably money? There's a place in this world for people like me, right? The dreamers?

The silence lasted all the way home.

To be continued in a later post...

Posted by

Missy

at

8:00 AM

0

comments

![]()

Tuesday, January 15, 2008

The Coffee Shop Around the Corner

Last weekend, my husband and I got into a fight. It was a big fight. It happened in the car. Neither of us raised our voices. It was about money.

Money is in the top three reasons why couples split up, but "money" is a very broad term. What does that mean, exactly? Do couples split up because they make too little money for their lifestyle, or too much? What about the decisions on what to do with the money?

Our fight was not, in the literal sense, about money. It was about my dream of owning a small business, which costs money, which puts *our* money at risk, and which I can't talk about in front of my husband without him starting to wheeze a little around the edges.

To his benefit, I have to admit something here: I am a dreamer. There's a reason why I decided to stay home, and it's not the Y chromosome. It's because the 8-5 workweek -- and the mentality that comes with it -- makes me feel like a hamster at a wheel. It makes me feel small and insignificant and tired. I am a creative type, really. I write and take photographs and design another website, which I publicly claim (for better or for worse). I'm not a great artist, or a great writer, or a great anything. It is, however, what I enjoy doing. I keep hoping I'll make money at it, but I don't, and I just keep doing it anyway.

My husband is a very prosaic sort of person, the kind who would never take a vacation because he would just forget it was an option. I work in order for vacations to happen, and it never fails to amaze me when I eagerly inquire how much vacation time he has and he says, "I don't know." I have never not known. How can you not know? How can you not look, every two weeks, and say (to yourself) "Another .6 days! Woo Hoo!" Or whatever your vacation rate is.

Anyway, I am a dreamer, and among my dreams of publishing a book, or making money writing anything at all, I also like science and would like to go back to school for a science-related degree. I like to travel, and periodically try for a job with the foreign service. Or, when I'm feeling really wild, I cruise Dave's ESL Cafe, looking for jobs teaching English, and wonder how I can trick my husband into going along with me.

All the while he plods along, getting up every morning and going to work, putting a small amount of money in savings every week, paying bills and looking for better jobs and better work. Here's the rub, though; I don't look for "better" jobs, I look for "more interesting" jobs.

It would seem that a slow mover like my husband should really be the author of a personal finance blog instead of me, but I look at money the way I look at a job; it can be the vehicle to attain certain freedoms, like nicer vacations, early retirement, and a decent car. I would sell this house and everything in it, cancel my debt, buy a van and travel through Mexico for a year in a heartbeat, but I do have a practical side that feels responsible for my student loans and my children's education. I get it. I may not be good at it, but I get it.

So one of my dreams is to own a coffee shop (or a youth hostel, but I think the coffee shop would be easier). Of course, I came to this dream about 15 years too late; if I had started a shop when I graduated high school (1994) instead of now, I would probably already be financially free to a certain degree. But at 18, I was terrified of starting my own business, and everyone said "college!" and so off to college I went. I lost a lot of money, but I had a good experience. And experience is what living is all about, right? (I keep telling myself this as I write the loan checks)

Anyway, so my DH and I took the kids up to Mt. Lemmon, which is just north of Tucson, to play in the snow. We always go to Summerhaven, the little town at the top, and walk around and buy overpriced hot chocolates. It's just a weekend treat that we do every couple months, and I don't feel guilty about our $2.50 hot chocolates at all. We tend to stop at a little shop called The Living Rainbow, and we go in and goggle all the cool stuff.

The Living Rainbow is one of those quirky little shops where you can find things you just don't see anywhere else. For example, I can buy a t-shirt that says, "This generation plants the seeds; the next generation gets the shade," and by purchasing it, I ensure that one tree is planted. There are also fighting nun action figures, beads that melted in the Mt. Lemmon fire five years ago, and "unicorn" tarot cards. I love it.

The owner always remembers us -- my first child weighed nearly 10 pounds, and so did hers -- and this time, I stopped to chat with her, which I hadn't done in a very long time. I asked her how long she had owned the shop, and she said, 29 years. I was surprised! She looks very young. So I asked her how she had started it, and she explained that, 30 years previous, her husband had walked out on her and her two sons, aged three and one. She had no money, so she started the shop with just a few items, and everytime she sold one thing, she would use the profit to buy two more. She was so embarrassed by the fact that the shop was practically empty, that she put up a sign for "information," and would talk to and try to answer tourists' questions. When I asked her about her boys, she said that they stayed in the shop with her most of the time, although the town had a babysitting co-op that she participated in as well. I murmured my admiration for what she had done, and said that I sometimes thought of starting up a business but had always been too afraid, and at that she looked me in the eye and said, "Anyone can start a business. You could too."

To be continued in the next post.

Posted by

Missy

at

1:24 PM

0

comments

![]()

Wednesday, January 9, 2008

Having a baby, or how to lose $5,000 quicker than if you went to Vegas

In 1998, I finished my undergraduate degree in English Lit. and was offered two choices. Choice 1: take a job as an insurance salesman and be a bane to my friends (I had to take an test asking if I would feel comfortable trying to sell insurance to guests at a dinner party. I knew the right answer, but said "no" anyway). Choice 2: take a job teaching English in Japan. With $42,000 in student loans, I went to Japan.

In 1998, I finished my undergraduate degree in English Lit. and was offered two choices. Choice 1: take a job as an insurance salesman and be a bane to my friends (I had to take an test asking if I would feel comfortable trying to sell insurance to guests at a dinner party. I knew the right answer, but said "no" anyway). Choice 2: take a job teaching English in Japan. With $42,000 in student loans, I went to Japan.

Surprisingly enough, I actually paid off $8,000 in loans in just 2.5 years. Then I met the love of my life, flew home, and had the cheapest church wedding on record (we actually made money on the wedding -- I plan to put our method in a post very soon). We went to Washington, D.C., where my husband had been stationed as a Marine, and after a couple of frantic months I landed a salaried position working for a think-tank in downtown D.C. I had excellent benefits, we lived in a tiny apartment, had one paid-for car that got 42 mpg, and paid most of our bills (such as yearly car insurance) in bulk. We paid off another $2500 loan in just 4 months. Then I found out I was pregnant.

I knew, somehow, that babies cost money, so for the next 8 months I put approximately $750 a month in savings. We saved over $5,000 during that time. I didn't get paid maternity leave, so only planned to take 6 weeks, but $5,000 was more than enough to cover that. Plus, my husband was still working, and we planned to stagger our leave, with one of us home with the baby for the first 3 months.